The art of selling a $1 million software contract to an organization is a completely different ball game to selling a $120 annual subscription to one person.

Known as enterprise software sales, or complex sales, the selling cycle can last months. It involves building relationships with prospects and tailoring a solution that addresses their specific problems and needs.

While it’s not as quick as selling a lower-priced personal subscription, the benefits can also be huge. Enterprise software sales deals allow your company to lock in multiple-year contracts and higher revenue.

In this article, we’ll answer what enterprise software sales is, how it’s sold and how it’s different from traditional sales.

What is enterprise sales (and how do sales processes differ)?

Enterprise sales refers to the transaction of a high-value product or service to an organization that often involves customization and tailored onboarding. In enterprise software sales, this is usually a product or software as a service (SaaS) tool that an entire team, department or organization will use. In SaaS enterprise sales, this typically includes software as a service (SaaS) tools designed to streamline workflows, integrate with existing tech stacks and scale to meet the needs of large teams or entire organizations.

Enterprise sales are usually long, taking weeks or months, and may involve multiple decision-makers. It’s quite a different selling process to small business sales or B2C transactions. It can also be a riskier sales process because if the deal falls through, sales representatives have potentially put weeks of effort into a deal without any reward.

However, the upside for enterprise sales is that B2B sales organizations can close large, lucrative contracts with clients and feel more secure with annual and multi-year contracts.

The key difference in enterprise sales is complexity

Buying a personal subscription is usually simple: you select your plan, enter your details and get instant access.

Compared to software aimed at one person or small to medium-sized businesses (SMB), enterprise software is often more complex. Usually, this is because it must be customized to suit a company’s unique needs.

At this level, prospects usually need extra support and persuasion to close the deal. Therefore, software sales are often managed by sales executives (sometimes account executives) who know the product inside and out (especially with technical products).

Software sales usually happen in one of three ways: self-service, transactional or enterprise sales.

The self-service model

When a customer completes the sale by themselves, they’re following the self-service model. They pick a product or plan that suits them, pay for it using the payment platform, and onboard themselves using knowledge bases, tutorials and product documentation.

The transactional sales model

When a prospect self-selects a tool but still requires some help from sales or customer support with implementation and onboarding, it’s called transactional sales. This type of sale usually happens when products have a higher price point or can’t be used straight out of the box.

The enterprise sales model

Enterprise sales requires a more hands-on approach for the sale and organization-wide adoption to be successful. The company buying the product will need more training and help integrating it into their existing tech stack.

As Gartner highlights, the enterprise sales process involves several steps like live demos, ROI calculations, vendor onboarding and customized deal structure before a contract is signed.

This complexity sets enterprise sales deals apart from the rest, but it’s also what makes them the most profitable.

How enterprise sales can be used to close more OEM deals

Software isn’t always sold to the end-user; other software companies might also be prospects. OEM, or original equipment manufacturer software, is when a software company licenses its product to another company so they can embed it into their application.

For example, software companies building a CRM platform might want to include functionality that isn’t feasible to build from scratch, such as document creation or one-touch video call integration. If the technology already exists in the market, the CRM software company might look into licensing the tech instead.

The end-user can then benefit from having all their needs met in one tool, even though part of that need is met by another technology company.

OEM deals are just as complex as a standard B2B enterprise deal, so the closing process is just as high-stakes.

What is enterprise software?

Enterprise software refers to a category of computer applications specifically designed to meet the complex needs of large organizations or enterprises. It typically encompasses a range of integrated software solutions that facilitate various business processes and operations, such as customer relationship management (CRM), enterprise resource planning (ERP), supply chain management (SCM), human resources management (HRM) and more.

Enterprise software is known for its scalability, robustness and ability to handle high volumes of data and transactions. It is typically tailored to meet the specific requirements and workflows of an organization, helping to streamline operations and enable better decision-making.

Enterprise deals are complex, but your sales professionals can navigate the enterprise sales cycle much better with a well-thought-out sales strategy in place. By following these four steps specifically designed for the enterprise sales cycle, you can effectively initiate sales at the enterprise level.

How to sell enterprise software in 4 steps

Enterprise deals are complex, but your sales professionals can navigate the sales cycle much better with a well-thought-out sales strategy in place. Follow these four steps to start selling at the enterprise level.

1. Find realistic buyers in your targeting pool

Because salespeople might be dedicating weeks or months of their time to a sale, it’s worth nailing down the basics. Help each one of your reps use their time as wisely as possible by targeting the most realistic buyers.

Gartner outlines the “Enterprise persona”, which focuses on four key areas: firmographics, demand drivers, technology environment and the decision process.

The firmographics are organization basics, such as the size of their company and the industry they’re in. This is important because startups with investors can view purchase decisions differently from public companies, for example.

The demand drivers are the reasons forcing the change in software, like shifting regulations or competitive pressures.

The technology environment involves getting an overview of their current technology landscape, including legacy technology and preferred vendors.

The decision process is a look at who the key decision-makers are in the organization and whether it needs to go through several people before getting the green light.

To pinpoint your sales efforts, you should identify these details in your ideal customers and match your prospecting list to this buyer persona accordingly.

Then you’ll need to dig into the enterprise buyers’ needs and buying process. Try to uncover as much information as you can about the following:

Their drive. How will your software help the prospect meet their technology goals? Is the prospect driven by business goals or a desire to improve their tech stack?

Their buying cycle. Are they ready to buy now? How long does the company normally take to make a buying decision? How do they budget and plan for new software implementation?

Their motivation. Why do they want to buy your product? What is their need to purchase new technology? Is their current software outdated? How will your product help them?

After asking these questions, you should have a good idea about what a realistic enterprise customer looks like.

For example, a prospect looking to update their existing tech stack may want to do so because they feel the pressure of falling behind their competitors. But it might be because it will help them win new business opportunities. Identifying the driving force behind your target’s buying decisions is worth knowing for both sales and marketing purposes.

Once you know what your target enterprise customer looks like and you understand their motivations, it’s time to find them.

You can start by searching sites where ideal prospects hang out, like LinkedIn (over 62% of B2B buyers respond to sales reps that reach out with relevant insights and opportunities).

Or, try a prospecting tool to narrow down the right people to talk to. For example, Pipedrive’s Prospector tool collects high-quality data that match your ideal customer parameters, such as job title, company size, location and industry.

With this information, your sales reps can reach out and start a conversation related to the drivers you identified in your target enterprise persona research.

2. Target the decision-maker

Don’t just reach out to anyone at the company you’re targeting. Contact someone who makes these types of decisions and has access to company funds.

Targeting decision-makers early in the selling process can save you time talking to gatekeepers and others who don’t have any say in the company’s tools and software.

Employing the MEDDIC lead qualification methodology can help here. The methodology encourages sales reps to take an upfront approach to prospects and ask qualifying questions like:

“How does your organization typically make buying decisions?”

“Is anyone else involved in the buying process?”

“What’s your role in the decision-making process?”

The answers to these questions will tell you if you are talking to the right person or if you need to escalate the conversation to a decision-maker.

Once you’ve started a conversation with the decision-maker, it’s time to take them down the customer journey that convinces them to invest in your software.

3. Nail the enterprise customer journey

Enterprise customers are harder to close than others because enterprise software is usually a big investment. Changing software can require budget, time, resources and external support, like change management professionals that support tech adoption.

To win the deal, you’ll need to convince the decision-maker that it’s worth it.

On this, CEO and founder of GoodData Roman Stanek explained:

“If you want to sell your technology to the enterprise, you have to solve real problems for the enterprise, and you should expect to have a substantial sales and marketing operation.

“Fundamentally, the product has to make work easier, integrate better with other systems, and meet much more stringent requirements than a consumer product would. The enterprise is a large and slow-moving but a powerful and valuable animal. Capturing it requires addressing its concerns and its persona head-on.”

So, what does it take to address an enterprise prospect’s concerns?

First, approach them with a value proposition that they can imagine significantly helping their company. Starting a meaningful conversation with an enterprise prospect hinges on them understanding exactly what your product will do and how much it’ll help their organization in daily work life, like productivity, profitability or another benefit.

Once you’ve communicated your product’s value, focus on three things:

1. Give examples of value-added scenarios. Show the prospect how your product has benefited similar customers and explain how it’ll help them achieve their goals if they use it. Give them real-life examples that show how your software solved a specific problem or helped an existing customer grow.

2. Prove that your software is enterprise material. Enterprise companies are often looking for ways to expand and scale. Show your prospect that your enterprise software can grow with their existing tech stack and that it is secure and reliable enough to handle enterprise-level pressure (like high-volumes or multinational data sets).

3. Play the long game. Enterprise deals aren’t closed overnight, so don’t try to force it or you’ll risk losing your prospect. Get comfortable with the long sales cycle at the enterprise level and pencil in regular (but not too regular) follow-ups.

When you get to the point where your prospect is ready to take the plunge and buy your product, the final step is closing the deal.

4. Close the deal

Closing an enterprise software sale involves more than signing a contract and releasing login details.

It’s crucial that every new enterprise customer feels supported during the onboarding and deployment phase after the deal is done. Enterprise software can take several weeks to implement, so it’s important that your company is supporting the new customer every step of the way.

If you don’t, users might fail to understand your software or how to use it regularly. They might even decide not to continue your deal in the future, especially if they never get it off the ground.

At Pipedrive, customers on our Enterprise tier receive tailored onboarding to streamline their software setup through our implementation team. They’re also given access to phone support.

When the ink on your new customer’s contract is signed, that doesn’t mean your work is over. Enterprise customers pay top dollar for customized products and experiences, and during the closing phase of the deal, that value needs to be delivered.

Sales strategies to use on enterprise deals

You don’t have to reinvent the wheel to be successful at enterprise software sales. Here are three sales strategies to use when trying to close bigger deals.

1. SPIN Selling

SPIN selling is a strategy where sales reps build a relationship with a prospect to tailor a solution that matches their problem.

The methodology centers on a four-part questioning framework:

Situation. Asking about a prospect’s processes, tools, objectives and responsibilities, so sales reps can learn about their goals.

Problem. Asking about the prospect’s challenges to build a solution around individual needs.

Implication. Asking about the problems uncovered in the previous step to help understand how they negatively affect their company. These questions reframe the size of the problem and increase the sense of urgency in solving them.

Need. Asking about potential solutions your prospect has already come across and introducing your company's enterprise software solution.

Reps should ask situational “SPIN” questions to guide their prospects through the sales funnel rather than following a rigid script, making it a good strategy for individual enterprise prospects.

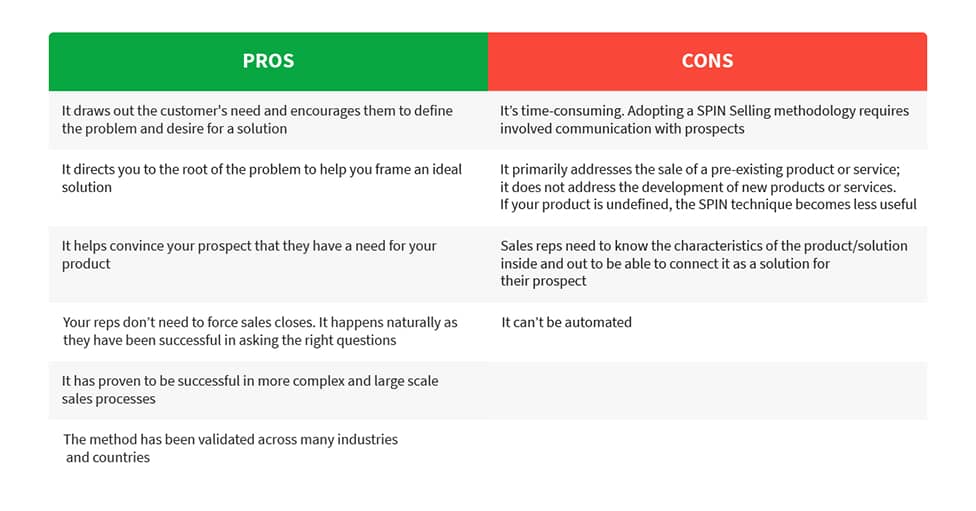

You should choose the sales strategy that best suits your enterprise prospects and your sales team. Here are some pros and cons to consider about the SPIN method:

Want to know more? Read about how SPIN Selling can be used in more detail here.

2. Challenger selling

The Challenger sales model is a sales process that focuses on taking control of a sales experience based on a prospect’s individual problems.

This method empowers sales reps to intentionally dispute their prospect’s way of thinking and forces them to contemplate a new perspective. Once the sales rep creates some tension, it opens the door to having a casual debate with the prospect while encouraging them to consider new opportunities and an alternative way forward.

Once that alternative way forward has been created, sales reps can introduce their company’s enterprise software as a uniquely positioned solution to solve the prospect’s problem.

Here are some pros and cons to consider about the Challenger selling strategy:

Want to know more? Read about how Challenger selling can be used in more detail here.

3. Consultative Selling

Consultative selling is when sales reps put the customer relationship above their desire to promote or sell a product.

This may seem counter-productive, but poor relationships with customers are one of the biggest reasons for churn. Companies are at risk of joining this statistic if they only focus on closing deals and not solving a prospect’s problem. The consultative selling approach focuses on your customer, their needs and their biggest pain points before you even think about offering up a product or service as a solution.

Taking the time to build trust with your customers helps you close deals and win repeat business, even if it might take a little longer than other sales methods. Unlike other sales strategies, Consultative selling encourages enterprise customers to look past your product's price tag and instead focus on its value add.

Here are some differences between product-based selling and Consultative selling:

How enterprise software is changing the way we sell

Enterprise sales reps now have technology like AI at their fingertips to empower their selling process. AI is especially impactful in SaaS enterprise sales, where predictive analytics and automation tools can help identify prospects’ pain points and provide personalized recommendations in real time.

This new technology has the potential to identify whether a prospect is interested, assess emotions and changes in speech patterns and determine whether a sales pitch is hitting home with the decision-makers in the room.

As venture capitalist Asheem Chandna explains in Forbes, this kind of enterprise tech sales advancement could soon be used to analyze whether a selling strategy is persuasive enough, even when sales reps are pitching over video.

"Using predictive algorithms, a sales team could access insights in real-time, allowing them to adjust their arguments on the fly or recognize more quickly when a sale can’t be closed," he says.

"Technology could be developed to identify the ‘champion’ in the virtual room along with the skeptic – letting the salesperson focus their argument on the right person on a multi-person conference call."

AI is now also helping mentor sales reps.

For example, the Pipedrive AI Sales Assistant analyzes the past performance of a sales rep and suggests new ways to get better results. It also uses an algorithm to scan what activities and actions each rep spends their time on and looks at whether or not they're focusing on working on low-value deals while more valuable ones go untouched.

Furthermore, free enterprise software trials are teaching us more about our target audience and teaching us how to sell better.

In the past, customers had to sign lengthy deals to test out complex enterprise products. Not anymore.

More software companies are now offering free enterprise trials to prospects so they can try before they buy. Companies aren’t doing this out of the goodness of their hearts; trials provide companies with valuable information about what tools enterprise customers prefer, how easy the software is to use for new users and if it lacks certain features they require.

This is shifting the burden off of what was traditionally required of sales reps in the past.

In the past, sales reps would outline the benefits of enterprise software in a live demo to a prospect, but they could not try it out themselves until they signed a hefty contract. Now, potential customers can try out the software, and during their trial, sales reps can jump in, communicate directly with them and resolve any issues to increase their likelihood of purchasing the software once their trial period is over.

By replacing in-person demos and visits with free software trials, enterprise sellers are getting the best of both worlds: showing prospects how great their product is while simultaneously collecting data worth its weight in gold.

Wrapping up

Enterprise software sales aren’t like other types of sales. It’s riskier, it requires your sales reps to put in more time and effort and your team needs to be in it for the long haul to be successful.

But the rewards can be huge. By customizing your sales techniques to solve each prospect's problems and building meaningful relationships with them, enterprise software sales can be incredibly lucrative for any software company.