Risk is a fact of life for every business, but not every company knows how to handle setbacks when they happen.

A robust risk management plan ensures you can prepare for challenges and respond effectively, minimizing disruption and cost to your business.

In this article, you’ll learn what risks your business might face and how to create a framework to protect against them. You’ll also learn how to plan and implement a risk management strategy to build resilience within your company.

Key takeaways

Risk management involves identifying and assessing risks to your business to minimize disruption and loss.

A strong risk management strategy empowers SMBs to make informed decisions, seize opportunities confidently and protect business continuity.

Without oversight, risks like stalled deals, customer churn or cash flow issues can escalate, but tools like Pipedrive help monitor, flag and mitigate these risks early.

Pipedrive centralizes deal, customer and project data, helping SMBs spot vulnerabilities and prevent losses – register for a 14-day free trial to safeguard your business.

What is risk management in business?

Risk management in business is how you identify, assess and address potential risks to your company, including financial, legal, strategic, external or project-related risks.

Strong risk management keeps SMBs stable when markets fluctuate, customer lifecycles shift or unexpected issues arise.

Companies use risk management frameworks to set guidelines on the levels of risk they’re willing to accept. These guidelines are particularly beneficial when making strategic management decisions, such as investing in new technologies or choosing new suppliers.

For example, an insurance firm considering launching a new cyber insurance policy would rely on its risk management framework to decide whether to proceed.

The risk management team would use the framework to answer questions like:

“Do our actuaries have the expertise to assess correctly and price cybersecurity risks?”

“Will our premiums be affordable and competitive while allowing us to make a decent margin?”

“Do we have the capacity to handle claims from thousands of customers if a global cyber attack occurs?”

“Could we afford to pay out if a big corporate customer fell victim to a targeted large-scale systems and data breach?”

A clear risk management framework ensures business owners and leaders can confidently explore new opportunities while readying their companies for any challenges they may bring.

Risk management vs. crisis management

Risk management and crisis management are two different but related ways of handling business challenges.

Risk management is proactive, identifying potential problems early and preparing to deal with them if they occur. Crisis management is reactive and designed to handle serious issues that unfold in real time and actively threaten your business.

Here’s a quick summary of the two approaches:

Risk management | Crisis management |

Identify potential problems early | Respond to a sudden event |

Plan strategies to avoid or reduce risks | Minimize damage as quickly as possible |

Continuously monitor and update risk assessments | Manage ongoing threats in real time |

Combining both approaches improves your company’s risk profile, making it more likely that you’ll avoid disruption and recover quickly if the worst happens.

What are the types of business risk?

You can typically categorize the dangers a business will face into 12 types of risks.

Here are those potential risks to businesses, with examples of what they might look like:

Type of risk | Result and example |

1. Financial risk | The potential for financial losses, like profits being impacted by currency fluctuations |

2. Operational risk | People, processes or systems-related issues, like an e-commerce retailer’s website crashing due to high demand |

3. Strategic risk | Factors that hinder a firm’s ability to achieve its goals, like a new product launch that doesn’t hit revenue targets |

4. Compliance risk | Consequences of not obeying regulations, like a marketing team not following GDPR/CCPA laws |

5. Reputation risk | Damage to a firm’s public image or brand, like a public failure in their corporate social responsibility policy or boardroom scandal |

6. Cyber risk | Challenges related to protecting customer data and/or IT networks, like a ransomware attack |

7. Political risk | Impacts from government actions, like no longer being able to trade with a country because of sanctions |

8. Health and safety risk | Workplace conditions that affect employee well-being, like increased absenteeism because of inadequate safety training or healthcare practices |

9. Commercial risk | Uncertainties relating to market conditions or business relationships, like a critical supplier going out of business |

10. Location risk | Geographic and environmental factors affecting business operations, like opening a retail store in a flood-prone area |

11. Quality risk | Possibility of substandard products or services, like a software company not thoroughly checking an app for stability |

12. Project risk | Variables that affect the outcome of a business venture, like weather-related delays on a construction project |

While these are all separate types of risk, they’re all connected.

For example, the insurance company we mentioned earlier would face a major compliance risk if it did not update its policies and IT systems fast enough to comply with new data protection laws.

This oversight might also morph into other risk categories, such as:

Financial risk. The company may be fined by the regulator, costing money.

Operational risk. It needs to overhaul its systems, disrupting normal operations.

Reputational risk. Its reputation for data compliance will be affected, eroding customer trust.

Many firms take an integrated risk management approach to protect themselves against these situations. They develop their initial strategy to deal with one risk that materializes while preparing backup strategies to handle other issues that might arise.

Note: Risk analysis and mitigation are key parts of project management. Factors like missing milestones, overshooting budgets and not having access to the people or resources needed are the root causes of many project failures.

What are the benefits of risk management?

An effective risk management process gives business leaders the confidence to make informed decisions and seize new opportunities.

At the same time, it protects the business from uncertainty and disruption.

Here are five ways risk management benefits your company:

Improves business strategy. Knowing the obstacles your company faces supports better decision-making, leading to improved outcomes and less uncertainty.

Optimizes efficiency. Staying on top of risk management can highlight internal bottlenecks. Spotting these bottlenecks allows you to streamline your business processes, improve productivity and reduce waste.

Builds stakeholder trust. An effective risk management program gives investors, customers, partners and lenders more faith in your leadership.

Ensures compliance. Following the laws and regulations in each country or region you operate in protects your firm from legal issues and fines.

Enables safer expansion. Assessing the risks involved in launching a new product or into a new market helps you plan for all eventualities, making success more likely.

Being risk-aware is key to building a robust business. It helps you make better use of your time, money and assets. You’ll handle setbacks more effectively, adapt faster to market changes and set yourself up for long-term success.

6 steps for implementing a risk management strategy

While risks are serious considerations, and there are many of them, it’s straightforward to create a strategy to manage and mitigate them.

Follow these six steps to create an effective risk management plan for your company and avoid costly disruption.

1. Develop a risk management strategy and team

A risk management strategy prepares your business for potential threats and lets you respond before issues escalate.

Before you take action, you must create a plan and gather the people responsible for it. Priorities and the ideal risk management framework will vary from business to business.

Here’s how to develop a strategy that suits your business.

Identify your priorities and measurement metrics

The objectives you choose will guide your approach and help you prioritize the most critical areas of your business.

Start by defining what you want to achieve with your risk management strategy. For example, your goals might include:

Protecting your assets from theft

Ensuring business continuity during pandemics

Staying compliant with ever-changing regulations

Minimizing card-not-present fraud

Once you’ve identified priorities, set KPIs to monitor when the plan is in place to check that your risk management plan works.

For instance, if your goal is business continuity, focus on operational resilience and backup systems. Your KPIs might be IT uptime and the time it takes to restore service after a system disruption.

If your priority is reducing card payment fraud, your focus might be on detecting and preventing unauthorized transactions. In this case, your KPIs might be the number of fraudulent payments processed and the percentage of card-not-present chargebacks.

Download Your Guide to Sales Performance Measurement

Choose your risk management framework

A framework is the steps you’ll take to identify, assess and manage risk.

It should be predetermined for as many risks as possible so the solution is ready to go when they appear. You could choose an existing, popular framework like ISO 31000:

You can also create a framework specifically for your business with simple steps like:

Categorize the risk (using the categories above)

Determine the scope of the risk

Identify solutions to alleviate the risk

Implement the best solution

Assess whether it works

Decide whether to continue or stop the solution

Monitor the situation

A custom plan often works for small businesses because you can fit your goals and the resources you have available.

Appoint a delivery team

Finally, you need a team to lead and oversee your risk management program.

Senior management should spearhead the effort as this is where the ultimate responsibility lies, but you should involve staff at all levels. This approach is effective because middle managers and frontline employees can often identify new risks that senior teams may not know about.

Consider appointing a Chief Risk Officer (CRO). Hold regular risk committee meetings with senior and middle managers to get a full, up-to-date view of risk across your business.

You could create a RACI chart showing who is responsible, accountable, consulted and informed about each task or project in delivering your plan. It might look something like this:

Now that you’ve defined your goals, chosen your framework and built your team, you’re ready to tackle the next steps in the process.

Note: People often mix up “risks” and “threats”, but they’re different in risk management. A threat could cause harm, like a natural disaster or a cyber attack. A risk is the possibility of loss or damage if that threat happens. For instance, a data breach is a threat, while the financial and reputational damage it could cause is a risk.

2. Run a risk audit and create a risk register

A company-wide risk assessment uncovers potential business risks so that you can prepare a solution.

Start by listing all possible risks to your business, both internal and external. An internal risk might be employees accidentally clicking on phishing links. An external risk might be a competitor emerging in the market.

Once you’ve identified each risk and response plan, note each one in your risk register. A risk register is a document or spreadsheet that records each risk, its severity, potential impact and how you’ll respond.

It’s a central resource for you and other business leaders to monitor the company’s risks and ensure you have an adequate response for each.

For the insurance company from earlier, an example of risk might be:

Commercial risk identification: Failure of a major reinsurance partner |

|

Each risk register entry describes the threat, its potential impact and how the company will manage the situation effectively.

A risk register highlights the range of vulnerabilities your business is exposed to, helping you identify areas that need attention.

3. Prioritize risks based on risk appetite

Your risk appetite determines how much risk you’re comfortable with as an organization – consider it your risk acceptance threshold.

Defining your risk appetite is critical to making strategic decisions that fit your broader business goals. It’s how you can pursue growth while handling the uncertainties that come with it.

For example, the insurance company may have a higher risk appetite because its management team focuses on growth. As a result, it’s willing to sign up larger clients on more flexible contracts to break into the corporate market. It accepts that this flexibility might affect the firm’s bottom line but prioritizes expanding its market share and client base.

Compare that to one of their large, well-established competitors. It may have a much lower risk appetite when signing up big clients because it has shareholders to consider and a responsibility to protect long-term profitability.

Deciding on your organization’s risk appetite helps you strike the right balance between opportunity and caution, allowing you to pursue growth without compromising your firm’s longer-term stability.

Note: Risk tolerance is how much risk you’ll take to achieve business goals.

For example, you might risk investing in custom software to streamline your operation, lower costs and become more competitive. You’re prepared to face uncertainty, high upfront costs and a risk of failure to achieve goals.

This flexibility gives you room for growth while helping you prepare for setbacks and limit potential losses.

Risk matrix

Prioritize each risk based on its likelihood of happening and its level of impact on your business.

For this, many companies use a risk matrix. Here is how you create a risk matrix:

Rate each threat in your risk register on a scale of one to five for impact, where one is minimal and five is significant

Do the same for the likelihood of each threat, where one represents a very low chance of happening and five is certain to happen

Add the two scores together, then place them on your risk matrix.

There are two axes on a risk matrix, one for impact and one for likelihood, like this:

The higher the combined score, the more critical the risk.

For example, a score of 10 (five for impact and five for likelihood) indicates a severe risk that you should attend to immediately. A score of two (one for impact and one for likelihood) is a minor risk, and you shouldn’t prioritize it over more serious risks.

After prioritizing risks, decide the order of actions needed to safeguard your business. You’ll then be ready to push your business forward and seize new opportunities while responding to potential challenges.

4. Determine how you manage risks

After classifying each risk, the next step is to decide on your risk treatment strategy. Think of these as your internal risk controls.

The standard approaches are:

Risk avoidance. Stop a high-risk activity completely so you eliminate the threat.

Risk acceptance. Acknowledge the risk but take no action, as addressing it would be too costly.

Risk mitigation. Continue the activity, but have a plan to reduce the impact if a threat materializes.

Risk transfer. Move the risk to a third party like an insurer or an outsource partner.

Develop a response plan for each threat you identify.

For example, you might respond to a phishing scam by training employees to identify these emails (risk avoidance). If they click on one, they’ll immediately contact the IT department, which will immediately prioritize tasks like checking for malware and changing passwords (risk mitigation).

Decision trees allow you to analyze each risk and foresee the potential results, even in uncertain situations. Whiteboard tools like Miro allow teams to collaborate on solutions for each risk.

In a decision tree, you map out your choices, the risk events that might follow and the possible outcomes.

You see all the paths and outcomes before you, making it easier to see additional risks for each action. You can more easily determine which option will deliver the best result.

Let’s return to the insurance firm we’ve used as an example. In this case, it’s chosen a mitigation approach:

Threat: Major cybersecurity breach exposing customer data |

|

By choosing how to handle each risk on a case-by-case basis, you apply the most appropriate solution to each situation. You can manage the risks your team can handle while passing others to external experts with the skills, technology and knowledge to address them.

Note: Some businesses offer risk management services. However, they tend to be suitable only for much larger companies because of the often high costs and the complexity of the types and volumes of risks they handle.

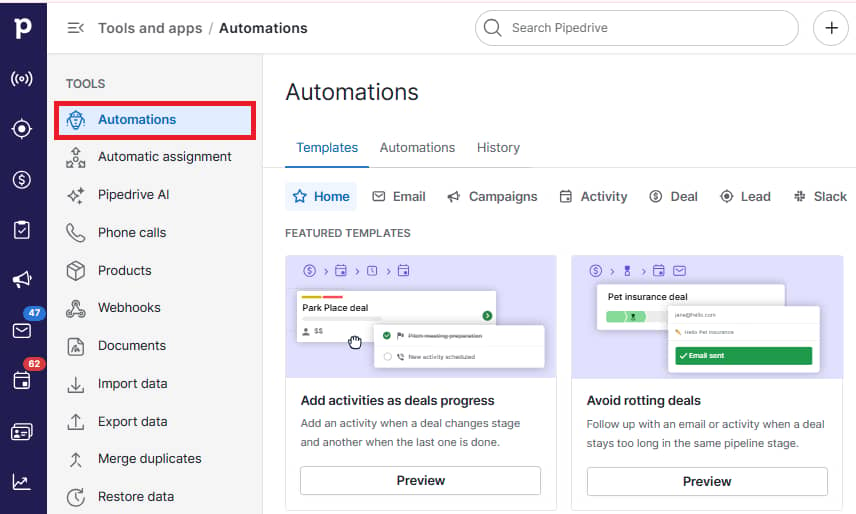

5. Adapt your tech stack and consider specialist software

Before investing in risk management software, consider how your existing software could help.

Many SMBs can customize their current apps to cover key areas of risk management.

For example, with features contained in Pipedrive’s all-in-one CRM, you could manage:

Cyber risks. Protect data and prevent unauthorized access with user permission management, single sign-on and two-factor authentication.

Operational risks. Automate your sales pipeline so you don’t miss out on revenue opportunities. Ensure your reps get notified every time they need to progress a deal.

Compliance risks. Centralize customer data and deal information to protect against data loss and ensure compliance with regulations like GDPR and CCPA.

Reputation risks. Integrate with survey tools to track metrics like your Net Promoter Score (NPS) to monitor customer satisfaction and catch any issues before they affect your firm.

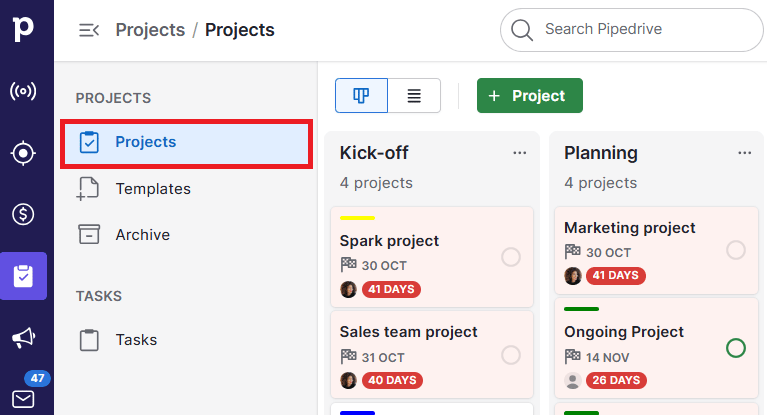

You can also reduce project-related risks by keeping track of progress with Pipedrive’s pipeline views and Projects by Pipedrive:

Other apps, like your CRM and bookkeeping software, also let you automate notifications. For example, you can prompt your credit control team to chase overdue invoices to support risk reduction.

Note: Contingency planning is a key part of effective risk management practices. These are the plans you create in advance and deploy when a known threat becomes a reality.

6. Train your staff

Training your staff is vital to stop fraud, provide training on fraud awareness and how to spot phishing attempts.

Many risk breaches occur because of human error. Even with automated workflows to stop human error, employees can still make mistakes that put your firm at risk.

For example, supplier fraud occurs when a fraudster impersonates a business’s supplier to trick an employee into sending them money. No firewall in the world will stop this – only well-trained staff will.

Give each team member the knowledge they need to spot and manage the risks they’re likely to encounter. For example, teaching operations teams about supply chain management risks and sales reps about distance selling regulations.

Your existing apps may contain helpful tutorials for employees. For instance, Pipedrive Learn can teach your colleagues how to automate workflows to reduce the number of missed follow-ups, a key financial risk in business.

Properly trained employees are your best defense against risks that tech alone can’t stop. Investing in their education strengthens your overall risk management plan and helps you build a more resilient business.

5 risk management tools to protect your SMB

The right risk management solutions help you spot threats earlier, understand how they affect revenue and make decisions with confidence.

These tools also reduce manual work so your team can focus on growth instead of scrambling to solve preventable problems.

Here are five tools that help SMBs manage risk more effectively.

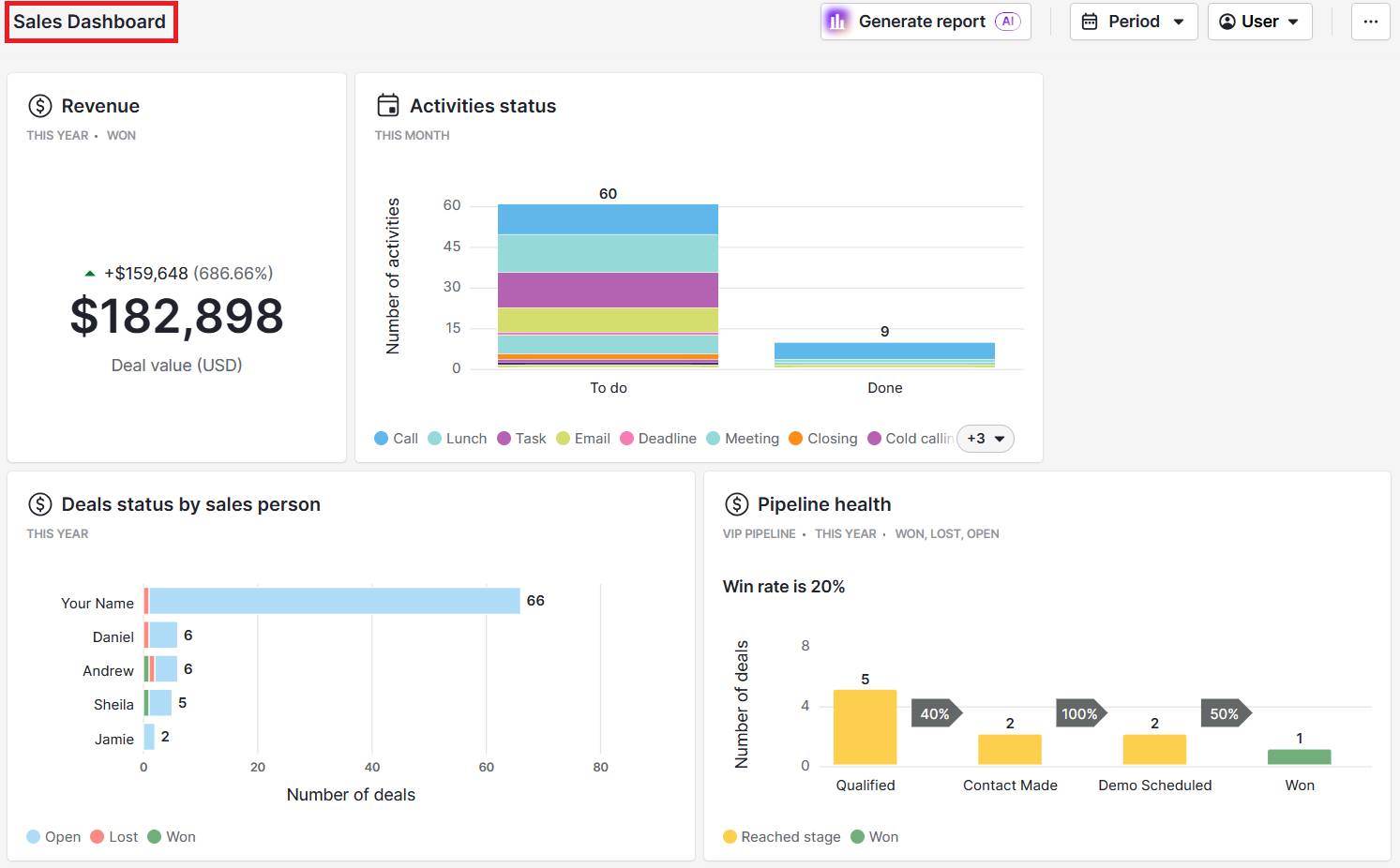

1. Pipedrive: Best for spotting and preventing sales pipeline risks

Pipedrive is a sales CRM that tracks deals, activities and pipeline performance in real time.

Pipedrive shows you where deals slow down, where follow-ups slip and where revenue becomes vulnerable.

Here’s how sales pipelines appear in Pipedrive’s interface:

By monitoring pipeline health daily, SMBs can take action before a risk becomes a missed target.

Pipedrive in action: Northwest Weatherization replaced manual spreadsheets with Pipedrive to streamline its sales process and improve visibility across deals. The company increased revenue by 15% in six months and boosted its lead-to-deal conversion rate to 5–7%.

Pipedrive is also flexible enough for SMBs with growing teams that need a simple system that scales without adding complexity. Users can easily add new pipelines, custom fields and automated workflows without changing how teams operate.

As your sales volume increases, Pipedrive adjusts automatically by updating forecasts, highlighting new bottlenecks and giving every rep a clear view of where to focus. These updates help SMBs keep control of their pipeline even as demands grow.

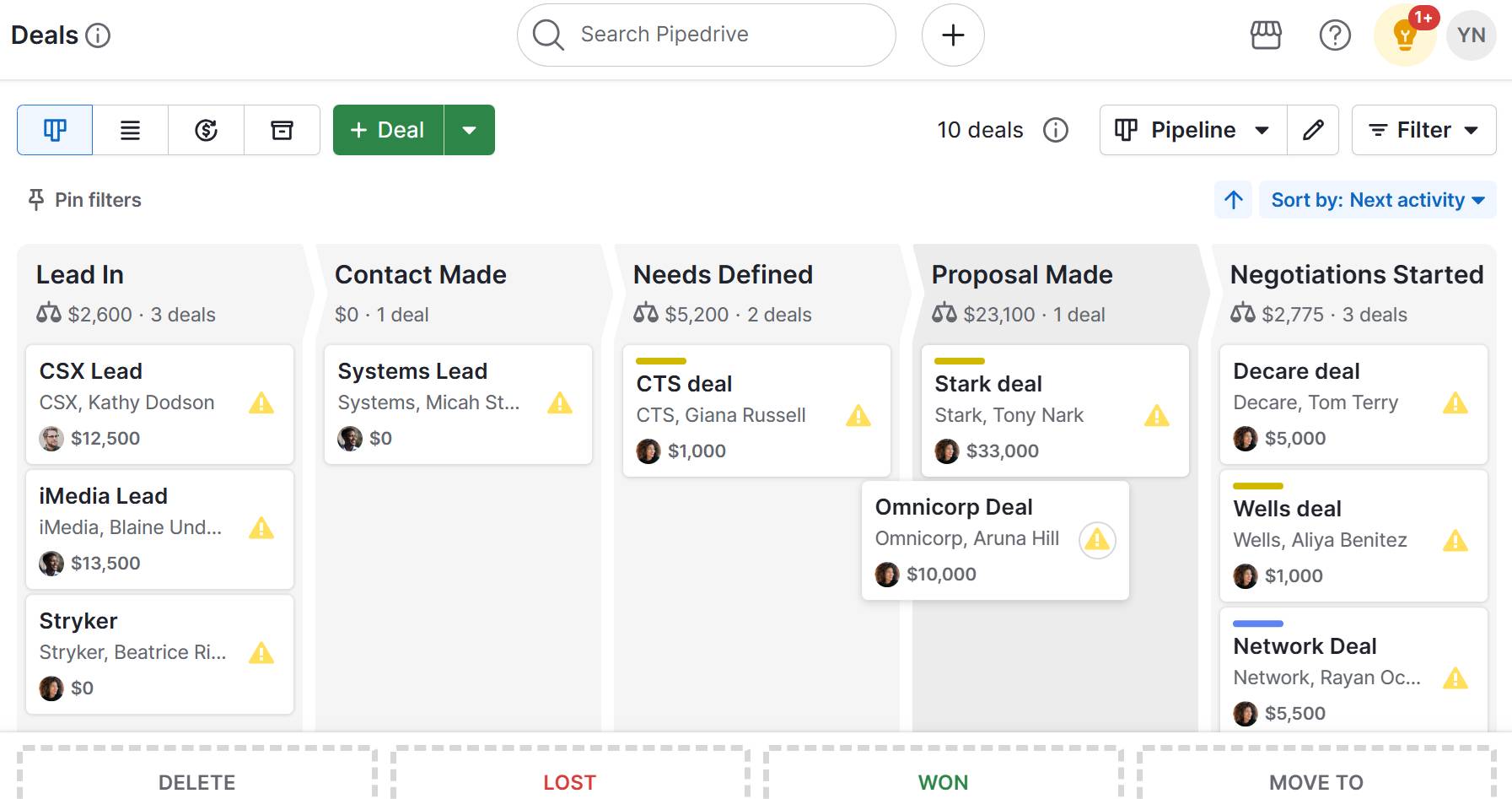

Take a look at the image below to see some of the workflow automations in Pipedrive:

Key features:

Pipeline visibility and forecasting tools

Automated follow-ups and workflow triggers

Custom dashboards for tracking deal risks

Deal probability tracking that highlights at-risk revenue

Activity insights that surface bottlenecks early

Custom fields that let SMBs tag and monitor unique risk factors

A well-structured pipeline in Pipedrive helps SMBs surface risks earlier, respond faster and prevent small issues from turning into revenue losses.

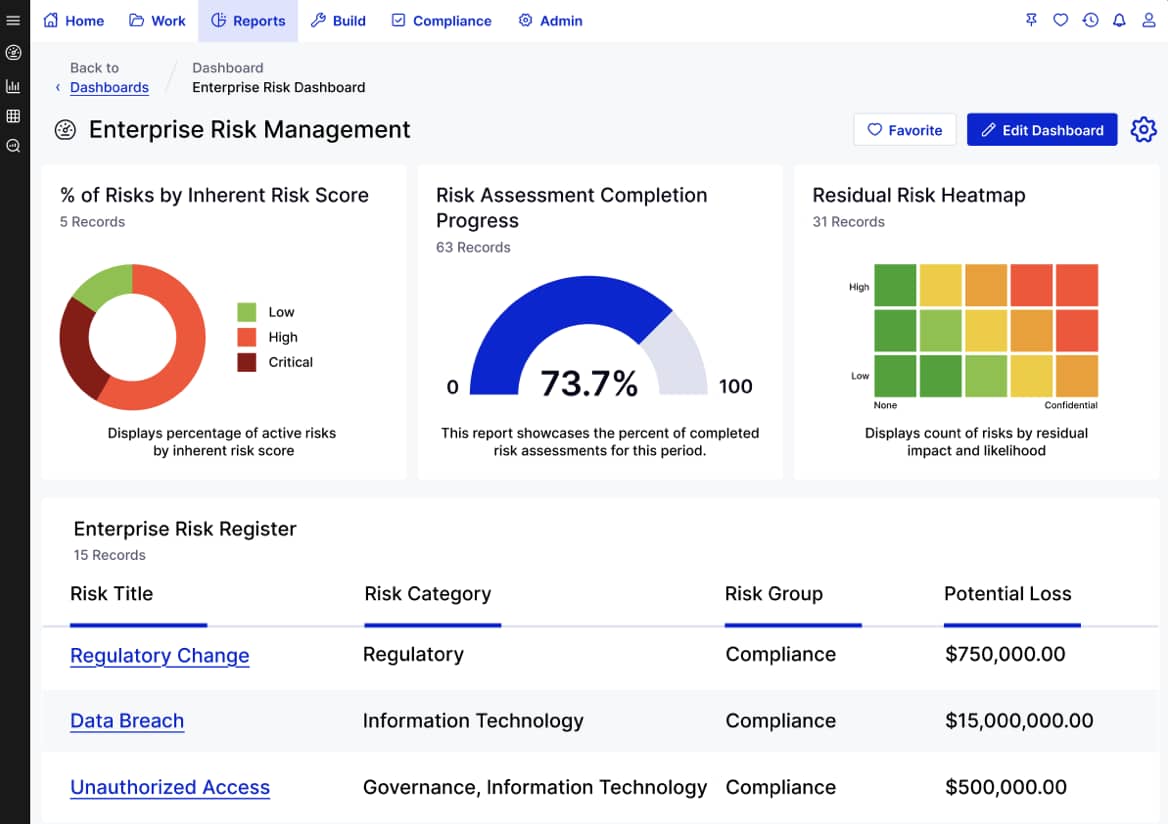

2. LogicGate: Best for centralizing and standardizing operational risk controls

LogicGate is a risk and compliance management platform that helps SMBs track, score and mitigate risk across operations.

The software provides a structured way to identify issues early and assign owners before they escalate. Users can pinpoint process gaps, compliance concerns and performance issues that may affect output or customer delivery.

Key features:

Risk scoring frameworks that help teams prioritize issues

Assigned responsibilities that clarify who owns each mitigation step

Centralized documentation that records decisions and actions taken

A centralized risk system in LogicGate helps SMBs spot operational threats sooner and maintain control.

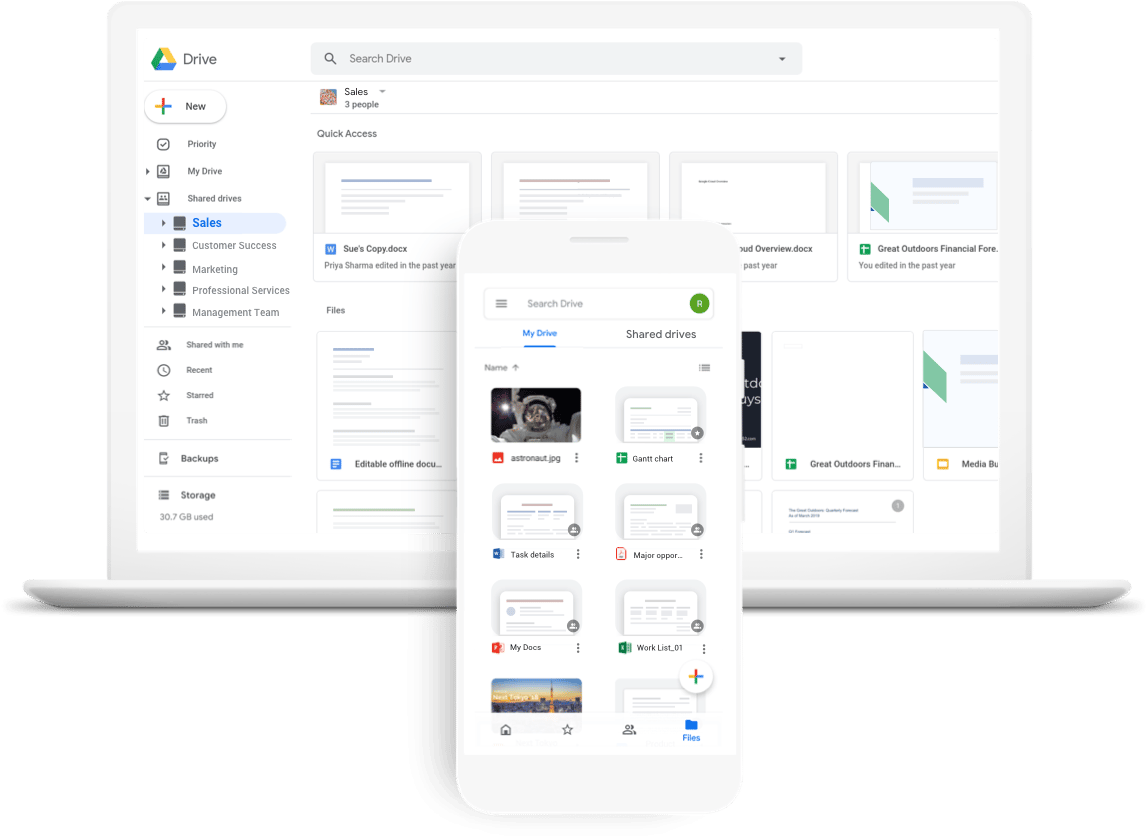

3. Google Workspace: Best for reducing information and collaboration risks

Google Workspace is a suite of cloud-based tools that help SMBs manage documents, communication and shared workflows.

The system lowers collaboration risks by organizing files, controlling access and reducing version errors. Teams always work from the right document, which prevents outdated information from causing compliance or delivery issues.

Key features:

Controlled file-sharing settings that limit who can view or edit documents

Real-time document activity logs that show recent changes

Centralized storage that reduces the chance of misplaced or duplicated files

A secure Workspace setup helps SMBs protect data, avoid miscommunication and maintain consistency across teams.

Note: Google Workspace integrates with Pipedrive so you can attach emails, documents and spreadsheets directly to deals and contacts. This connection provides clear visibility into communications and supporting files, reducing the risk of lost information or miscommunication.

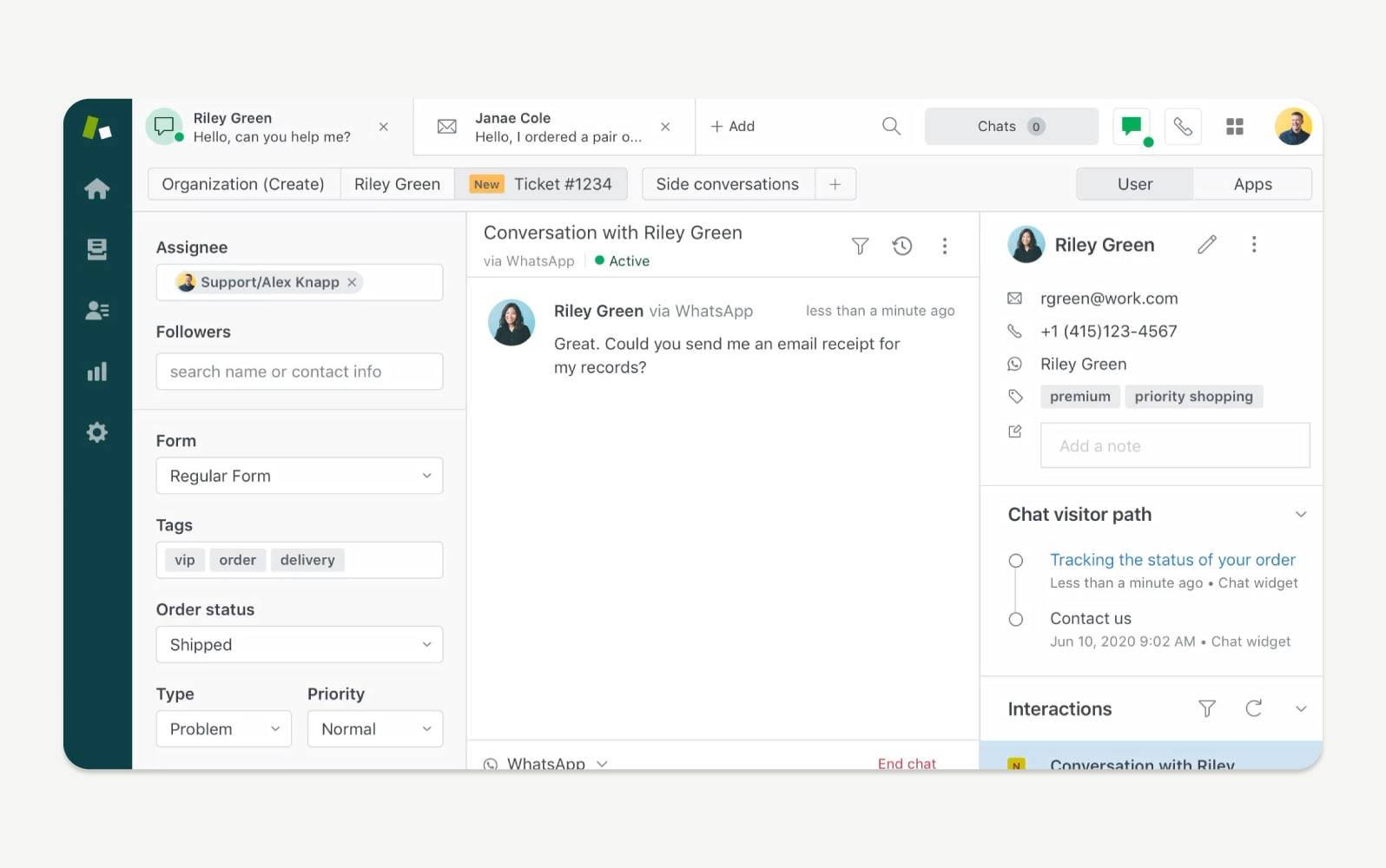

4. Zendesk: Best for reducing customer service and churn risks

Zendesk is a customer support platform that lets SMBs track issues, respond quickly and monitor service performance.

The software highlights rising complaints, repeated problems and slow responses that may put customer relationships at risk. With clearer visibility, teams can resolve issues before they lead to churn or negative reviews.

Key features:

Unified view of customer conversations across channels

Issue trend reporting to help teams identify recurring problems

Configurable workflows that standardize how cases move through support

A structured support system in Zendesk helps SMBs protect customer trust and address service risks early.

Note: Zendesk integrates with Pipedrive to link support tickets with deals and contacts. SMBs can monitor customer satisfaction alongside sales activity, flagging accounts that may be at risk of churn and proactively following up to protect revenue.

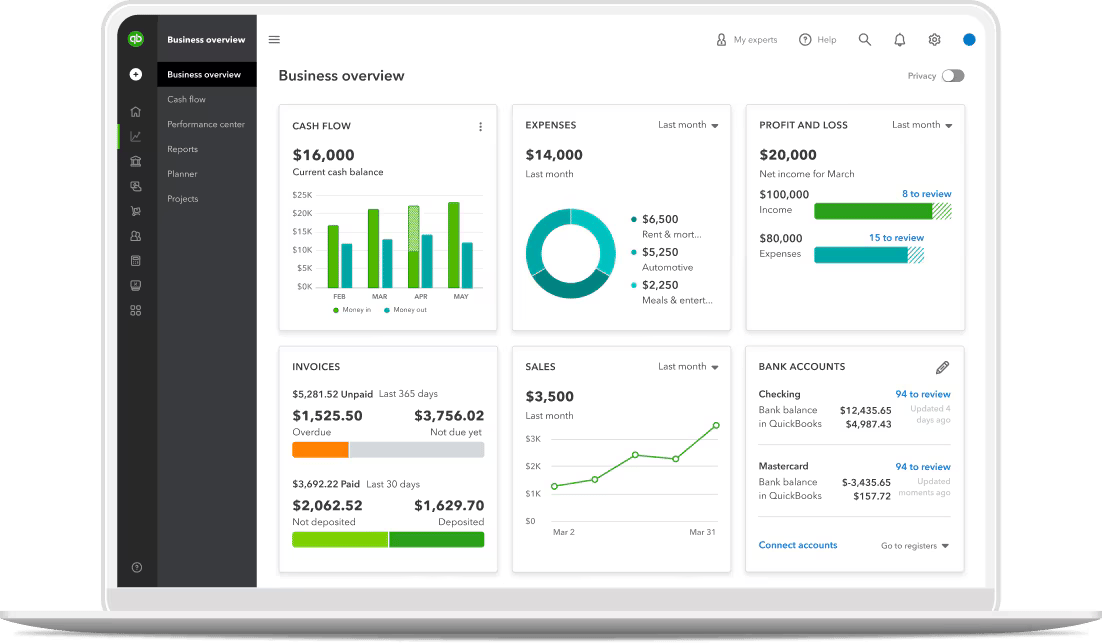

5. QuickBooks: Best for monitoring financial and cash flow risks

QuickBooks is an accounting platform that gives SMBs real-time visibility into expenses, revenue and cash flow trends.

The platform helps users spot unusual spending, shrinking margins or delayed payments before they affect financial stability. With clear reports, teams can act early to protect profitability.

Key features:

Cash flow snapshots that show short-term inflows and outflows

Transaction records that make discrepancies easier to verify

Basic reporting tools that highlight changes in monthly performance

A financial view in QuickBooks helps SMBs react faster, avoid surprises and plan with more confidence.

Note: QuickBooks integrates with Pipedrive to link invoices, payments and financial records to deals and contacts. Build a complete picture of financial risk for each deal to prioritize follow-ups, detect overdue payments and maintain healthier cash flow.

How to stay on top of risk management

Risk management is not a one-and-done process. It’s an area of business everyone needs to own and stay actively involved in.

Tracking and measuring the KPIs you set is critical. Your software can automate many of these tasks, allowing you to spot issues much sooner before they become a bigger problem.

You could:

Set up automated alerts. Ping your warehouse manager if inventory levels drop below target or your sales manager when the status of a promising lead has remained the same for several days.

Automate compliance checks. Set your accounting software to flag overdue payments or Pipedrive to inform you of hold-ups in internal project teams.

Track team performance. Look for dropping conversion rates, which may indicate that star reps are flagging. It may be your cue to provide top-up training and support.

Watch for new regulations, economic trends or political developments that might affect your business. Update the entries in your risk register regularly and revisit your risk appetite when needed.

Ensure you provide ongoing training to your staff, particularly on emerging threats. Offer best practice rewards and refresher courses. You could also appoint a risk champion to share insights across departments so the whole business stays alert.

Combining these approaches after implementation will put you in the best position to adapt your business as the threat landscape changes. Best of all, every employee will be a pair of eyes protecting the firm.

Final thoughts

Implementing a custom risk management strategy will help you identify and prioritize the threats you face, giving you a roadmap detailing how to address and overcome each threat if it materializes.

Staying on top of risk management, meaning regularly checking for changes to existing threats or the emergence of new ones, is key to company survival and growth. Switch your strategy when needed and involve your staff throughout the process to build resilience and tackle each challenge head-on.

Find out how Pipedrive’s range of features can be part of your solution to protect your company against risk. Register for a 14-day free trial.